10 Ways...

Tired of unpredictable markets and hidden trading costs? OmniFunds puts powerful, automated strategies at your fingertips—maximizing returns while minimizing risk. Unlike traditional trading, we help you avoid bear markets, eliminate costly order flow payments, and trade with 100% control over your account.

Whether you're looking for advanced AI-driven strategies, customizable portfolios, or real success stories, OmniFunds delivers a proven approach to smarter investing. Start trading the future, today.

10 Ways OmniFunds Beats the Competition

Reason 1

Trades Liquid Funds

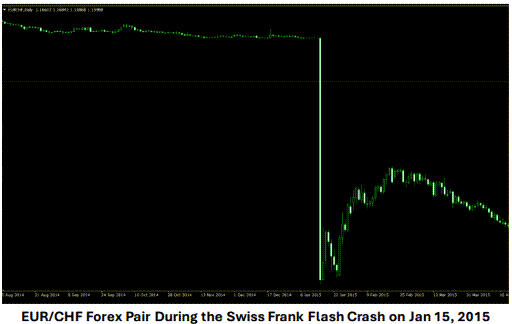

Unlike Forex, OmniFunds focuses on liquid equities, ensuring stability and transparency. With stocks, your investments are backed by real companies, making it virtually impossible to wipe out your account unless the entire stock market ceases to exist.

The Dangers of Forex Auto-Trading

Crash Examples 2011-2024

By Ed Downs

Intelligent Fund Management

September 23, 2024

Resource: Why Forex Algo-Trading is Dangerous. Documents 12 Major Forex Crashes that wiped out trading accounts.

Utilizes Advanced Market State Analysis

Reason 2

Market States

Avoid the pitfalls of bear markets with advanced Market State Analysis. While a basic approach might rely on simple Moving Averages to gauge market direction, OmniFunds takes it to the next level. Our sophisticated algorithms analyze deeper market trends, helping you stay ahead and protect your investments during downturns.

Uses Market State Analysis to Avoid Bear Markets

This simple example uses Moving Averages to determine Market Direction. The Market States used in OmniFunds are MUCH more sophisticated.

Resource: How it Works From OmniTrader.com website.

Employs Cutting-Edge Algorithms for Optimal Switching

Reason 3

Advanced Algorithms

Harness the power of cutting-edge algorithms to make precise, short-term switching decisions. OmniFunds continuously scans the market to identify the best opportunities while strategically avoiding drawdowns. This intelligent, data-driven approach ensures your portfolio is always positioned for optimal performance.

Resource: OmniFunds 2 Blog Post

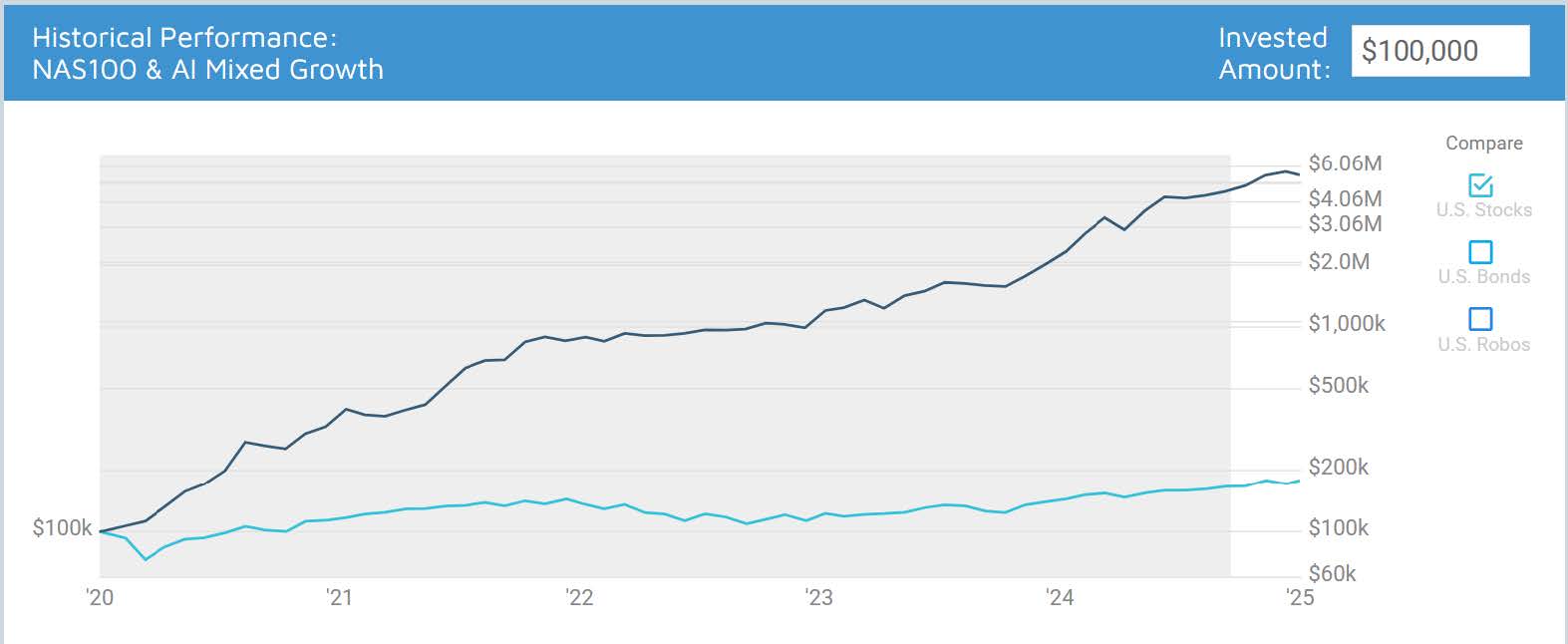

Achieves High Returns Without Leverage

Reason 4

No Leverage is Used*

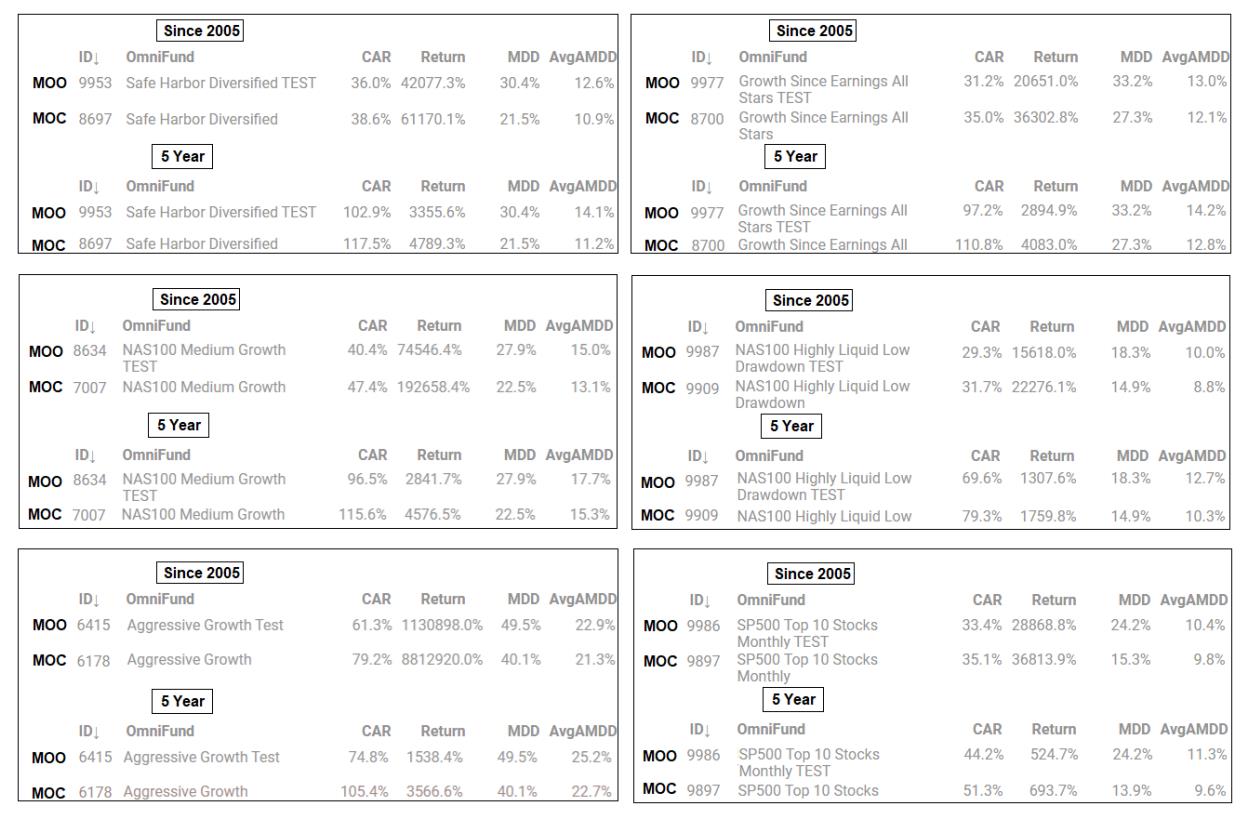

OmniFunds delivers powerful, consistent growth—without the risks of leverage. Some OmniFunds have achieved annual returns exceeding 100%, purely through strategic market positioning.

* You CAN apply 2x leverage if you are trading a margin account.

NAS100 AI Mixed Growth OmniFund is up an average of 114% over the past five years.

Avoids Earnings Reports to Minimize Risk

Reason 5

Avoids Earnings Reports

OmniFunds strategically sidesteps the uncertainty of earnings reports by exiting positions before announcements. This proactive approach helps minimize exposure to unexpected price swings. After the report, the algorithm reassesses the stock and re-enters if conditions align with optimal trading opportunities.

Executes Trades Before Market Close to Optimize Entries and Exits

Reason 6

Trades Market on Close

OmniFunds executes analysis before market close, strategically optimizing entries and exits to reduce the impact of overnight price gaps. By avoiding unpredictable “gap effects,” this approach enhances returns by 20% to 40%, ensuring better trade execution.

Partners with Interactive Brokers for Cost-Effective Trading

Reason 7

Interactive Brokers (no PFOF!)

Not all brokers are created equal. While many firms profit from Payment for Order Flow (PFOF), adding hidden costs to your trades, Interactive Brokers (IB) prioritizes transparency and savings.

OmniFunds Uses Interactive Brokers, LLC

Evolutionary Algorithmic Core

Schwab and other brokers pay market makers for order flow, which is added to the cost of your transactions.

I.B. does not offer Payment for Order Flow (PFOF) to market makers, saving $ on every trade compared to all the other brokers.

Interactive Brokers only charges a ½ cent per share commission resulting in savings on every trade.

Provides You with Complete Control

Over Your Account

Reason 8

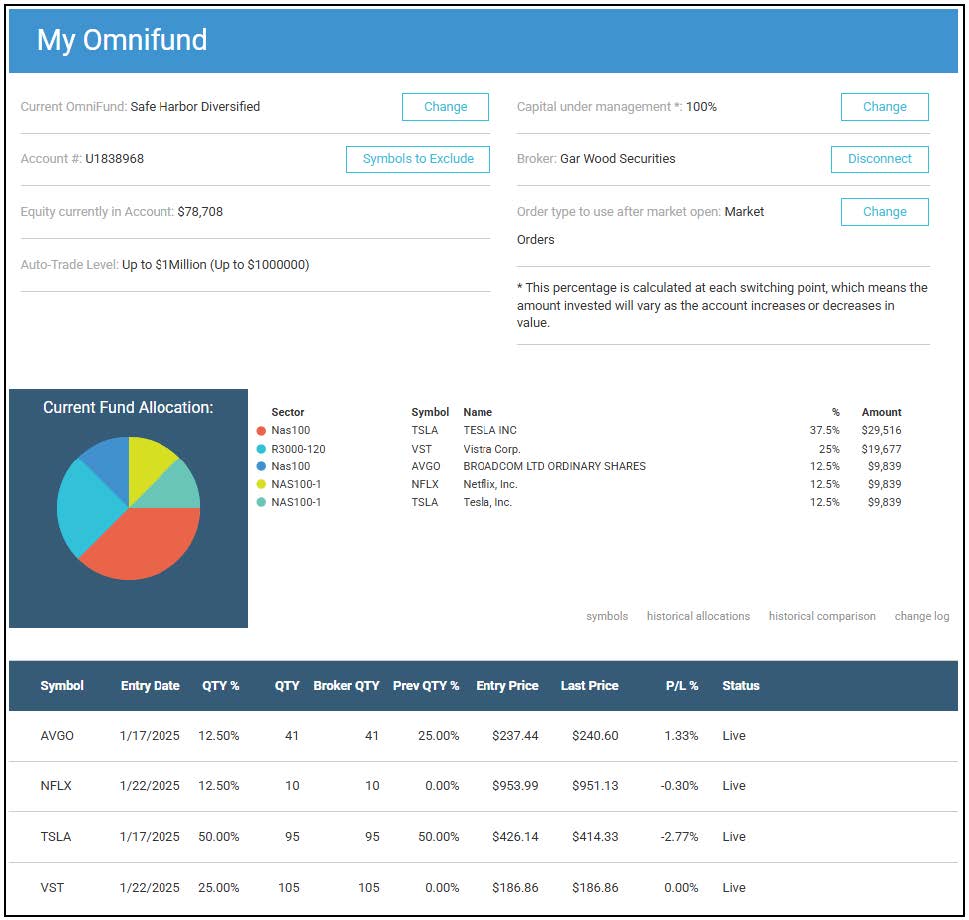

You Are in Control 100%

With OmniFunds, you have 100% control over your account. Start, stop, or switch between OmniFunds at any time, and easily transfer funds via ACH to and from your bank. Need to make a change during the trading day? Intraday adjustments are executed immediately, ensuring you stay in control of your investments.

Empowers You to Create Your Own Algorithms with OmniFunds Lab

Reason 9

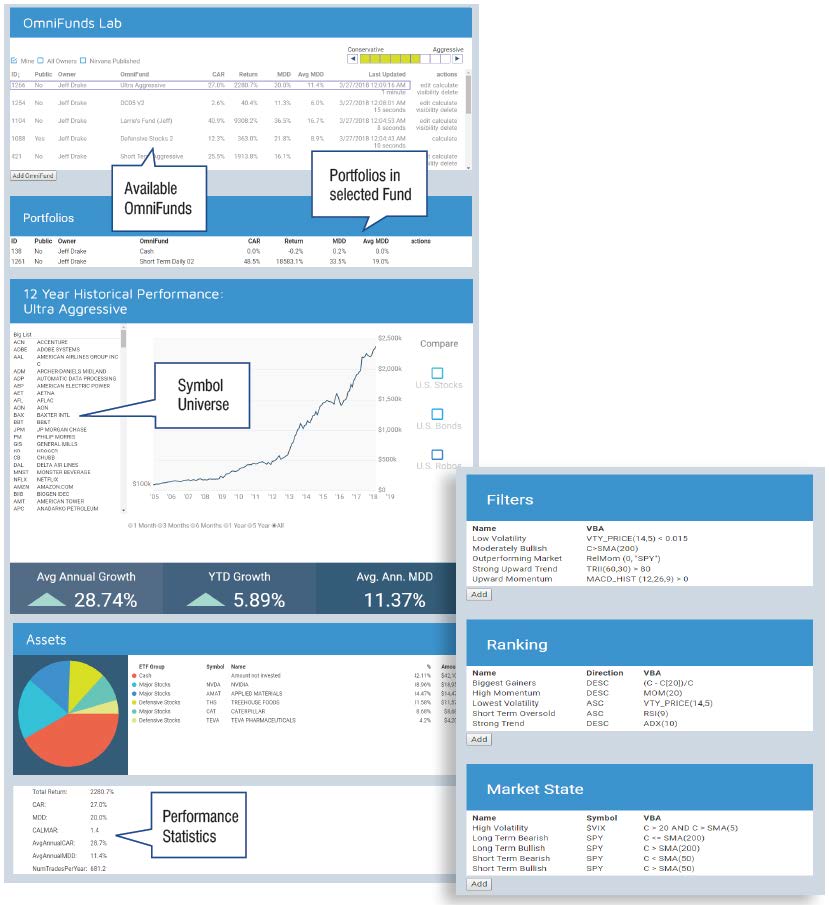

The Lab is Included (reg. $2,995)

Take control of your strategy with OmniFunds Lab—a powerful tool that lets you design custom OmniFunds by combining different portfolios. Easily tailor your investments to match your ideal reward/risk profile, ensuring a strategy that aligns with your financial goals.

Allows You to Create Your Own Algos.

Building Your Own Trading Algorithms

OmniFunds are created by combining “Portfolios” in the OmniFunds Lab.

Using The Lab, you can quickly customize OmniFunds to your optimal Reward/Risk requirements.

Real Success Stories from Satisfied OmniFunds Users

Reason 10

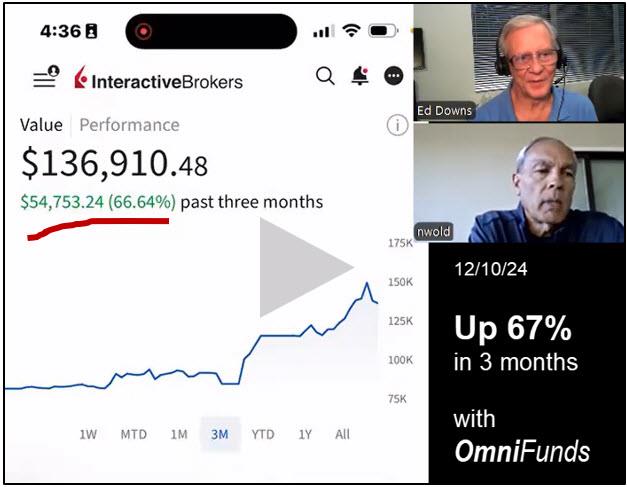

User Success

OmniFunds is helping traders achieve incredible results with powerful, automated strategies. Watch real user interviews and see how investors like Nick Wold achieved 67% returns in just 3 months!

Resource: 10-minute Interview with Nick Wold

Get a Personalized One-on-One Consultation

Ready to see how OmniFunds can work for you?

Schedule a free one-on-one consultation with our experts to explore how our advanced trading technology can help you achieve your financial goals. We’re here to help.